Scaling a Zero-Latency Trading Platform to $10M+ Profit in 12 months.

The Solana meme coin market was polarised. On one extreme was pump.fun—hyper-viral but plagued by regulatory risk. On the other were traditional aggregators—safe, but too slow for 100x moves. My role was to architect a terminal for the "Professional Degen": the trader who demands bot-speed execution with institutional stability.

The Market Gap

There was no home for the "Professional Degen"—the trader who demands the raw speed of a bot but the stability of a legitimate platform.

Safety vs. Speed

pump.fun offered viral speed but regulatory risk. Traditional aggregators were safe but too slow for 100x moves. We needed to close this gap.

Dual-Stakeholder Alignment

Harmonizing strategic priorities between a regulated fintech (MoonPay) and a data-heavy aggregator (DexScreener), each with distinct timelines and success metrics.

Zero Foundation

No existing design system, brand identity, or patterns. Moonit required a complete visual language and product DNA while sprinting toward launch.

The Credibility Gap

The platform needed to feel "native" to crypto-degenerates while maintaining the institutional trust of the MoonPay parent brand.

The Strategy: Achieving "Bot-Parity" Execution

In this market, profit and loss are defined in milliseconds. My primary design KPI was Time-to-Trade. We hypothesized that the standard pattern (Browse → Click → Details Page → Buy) was a primary friction point.

The "Pro Mode" Architecture

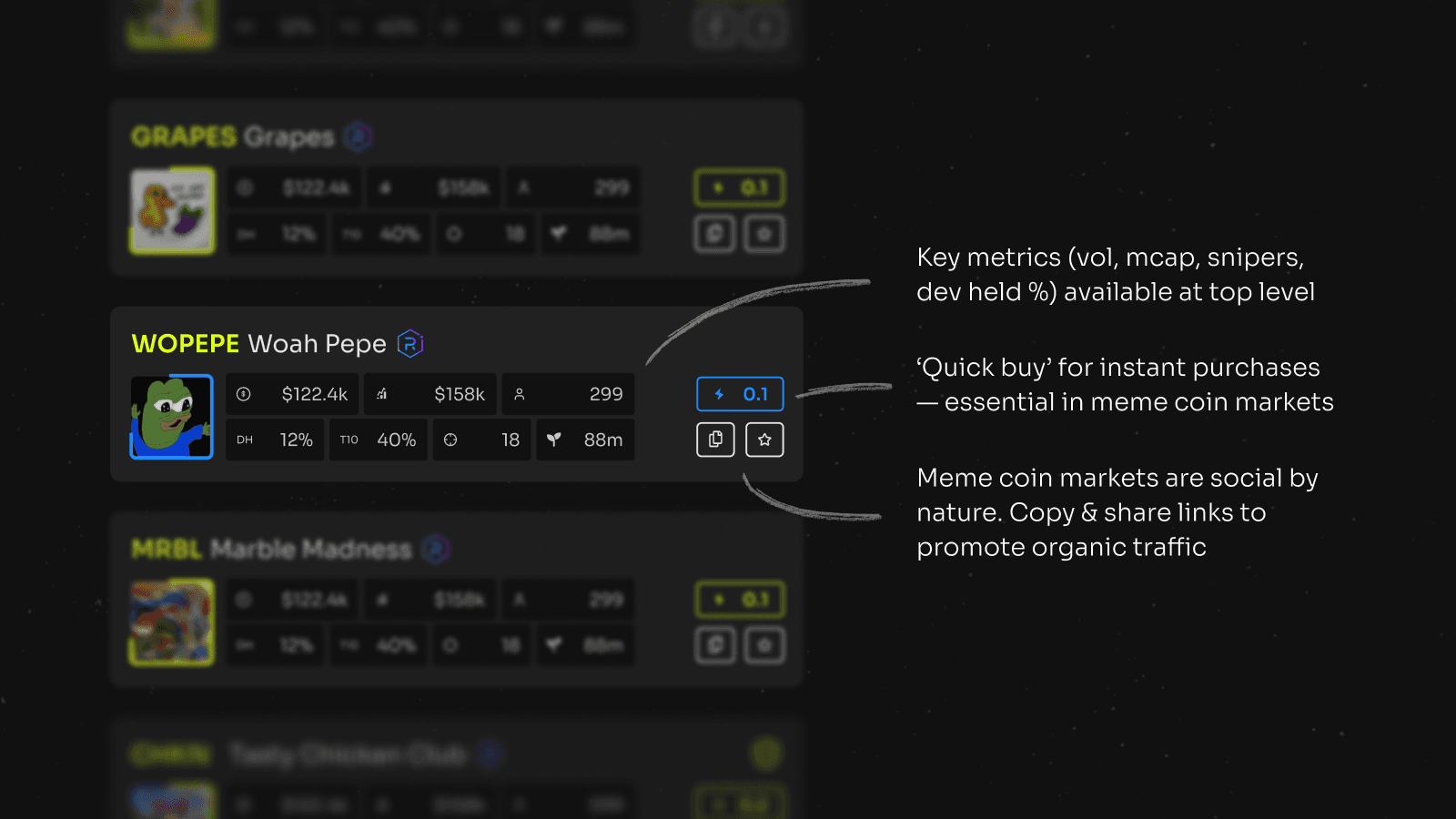

Direct Injection (Zero-Nav): Implemented "Quick Buy" inputs directly on index cards. Users can qualify and execute a trade without ever loading a secondary page—reducing interaction cost from 4 clicks to 1.

Session Mode: Designed a flow where users sign once to unlock a 1-hour trading window, eliminating the intrusive wallet pop-ups that break flow during high-volatility moments.

Signal Density: Curated data hierarchy to surface only execution-critical metrics (Liquidity, Market Cap, Volume), filtering out vanity metrics to support split-second decisions.

The "Pro-Degen" Visual Identity

Adopted a "Space Terminal" aesthetic—dark modes, monospace data density, and neon signal colors to match the mental model of a high-frequency trading desk.

Enforced rigid grid systems and explicit error handling to signal that while assets might be volatile, the infrastructure was solid.

Built a flexible design system that worked equally well on high-density trading dashboards and viral social marketing assets.

Department of One

Ownership of the full vertical: Product Strategy → UI/UX → Animation → Marketing. Ruthlessly prioritized "must-have" flows over "nice-to-haves" to meet aggressive profit targets.

Cross-Entity Alignment

Acted as the translation layer between MoonPay's corporate requirements and DexScreener's agile, data-first culture, delivering a unified product vision that satisfied both commercial entities.

Impact

Bot-Parity Achieved

The "Pro Mode" architecture reduced Time-to-Trade to under 2 seconds, matching the speed of automated trading bots.

Power User Retention

Successfully captured the "Professional Degen" segment exiting pump.fun for a more stable, regulated environment.

Brand Elasticity

Created a visual language that successfully bridged the gap between "Corporate Fintech" and "Crypto Native" audiences.